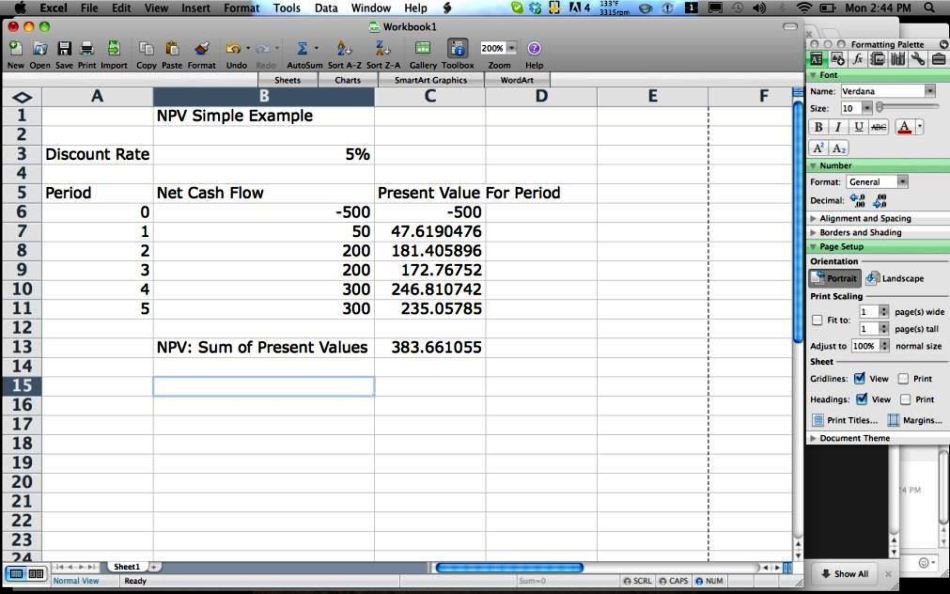

Net Present Value Excel Template - How to use the npv function in excel? The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Use this free excel template to easily calculate the npv. Web npv = net present value; It is used to determine the. Web how do you calculate net present value in excel? Therefore, the formula structure was =npv (interest rate,cash flow year 1 to. To do this, discount the stream of fcfs by the unlevered cost of. Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how to quickly do this in excel. Z1 = cash flow in time 1 z2 = cash flow in time 2 r = discount rate x0 = cash outflow in time 0 (i.e.

Professional Net Present Value Calculator Excel Template Excel TMP

Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Web what is net present value (npv)? Web net present value template. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. The formula for npv is:

10 Excel Net Present Value Template Excel Templates

Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Therefore, the formula structure was =npv (interest rate,cash flow year 1 to. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. The formula for npv is:.

Net Present Value Excel Template

How to use the npv function in excel? Web how to use the npv formula in excel. Where n is the number of. The formula for npv is: Web what is net present value (npv)?

Professional Net Present Value Calculator Excel Template Excel

Use this free excel template to easily calculate the npv. The formula for npv is: To do this, discount the stream of fcfs by the unlevered cost of. Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel.

8 Npv Calculator Excel Template Excel Templates

Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Web how do you calculate net present value in excel? Similarly, we have to calculate it for.

Net Present Value Calculator Excel Template SampleTemplatess

How to use the npv function in excel? Its value with all equity financing. It is used to determine the. F = future cash flow; Similarly, we have to calculate it for other values.

Net Present Value Excel Template

How to use the npv function in excel? First, we have to calculate the present value the output will be: F = future cash flow; Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. Web how do you calculate net present value in excel?

Best Net Present Value Formula Excel transparant Formulas

Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how to quickly do this in excel. It is used to determine the. N = the number of periods in the future; Web npv = net present value; Web net present value (npv) excel template helps you calculate.

Net Present Value Calculator Excel Templates

Web npv formula the formula for net present value is: Web net present value template. Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. Net present value is calculated using. First, we have to calculate the present value the output will be:

10 Excel Net Present Value Template Excel Templates

First, we have to calculate the present value the output will be: April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a. Web net present value excel template updated: Web what is net present value (npv)? Web net present value (npv) excel template helps you calculate the present value of.

April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a. Therefore, the formula structure was =npv (interest rate,cash flow year 1 to. Web npv = net present value; Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Web what is net present value (npv)? Web npv formula the formula for net present value is: Web how to use the npv formula in excel. Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how to quickly do this in excel. F = future cash flow; This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web net present value excel template updated: Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. N = the number of periods in the future; How to calculate net present. Use this free excel template to easily calculate the npv. Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. The formula for npv is: To do this, discount the stream of fcfs by the unlevered cost of. Web the npv function uses the following equation to calculate the net present value of an investment:

Web Step 1 Calculate The Value Of The Unlevered Firm Or Project (Vu), I.e.

Similarly, we have to calculate it for other values. Web the npv function uses the following equation to calculate the net present value of an investment: You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Present value is among the topics included in the.

Net Present Value (Npv) Is The Value Of A Series Of Cash Flows Over The Entire Life Of A Project Discounted To The Present.

Net present value is calculated using. Use this free excel template to easily calculate the npv. Web net present value template. Its value with all equity financing.

F = Future Cash Flow;

Web net present value excel template updated: Where n is the number of. Web how to use the npv formula in excel. The formula for npv is:

How To Calculate Net Present.

Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how to quickly do this in excel. It is used to determine the. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. To do this, discount the stream of fcfs by the unlevered cost of.